SECURING THE FUTURE OF RURAL COMMUNITIES AND AGRICULTURE

Since the beginning, we have been helping rural Americans secure a brighter future.

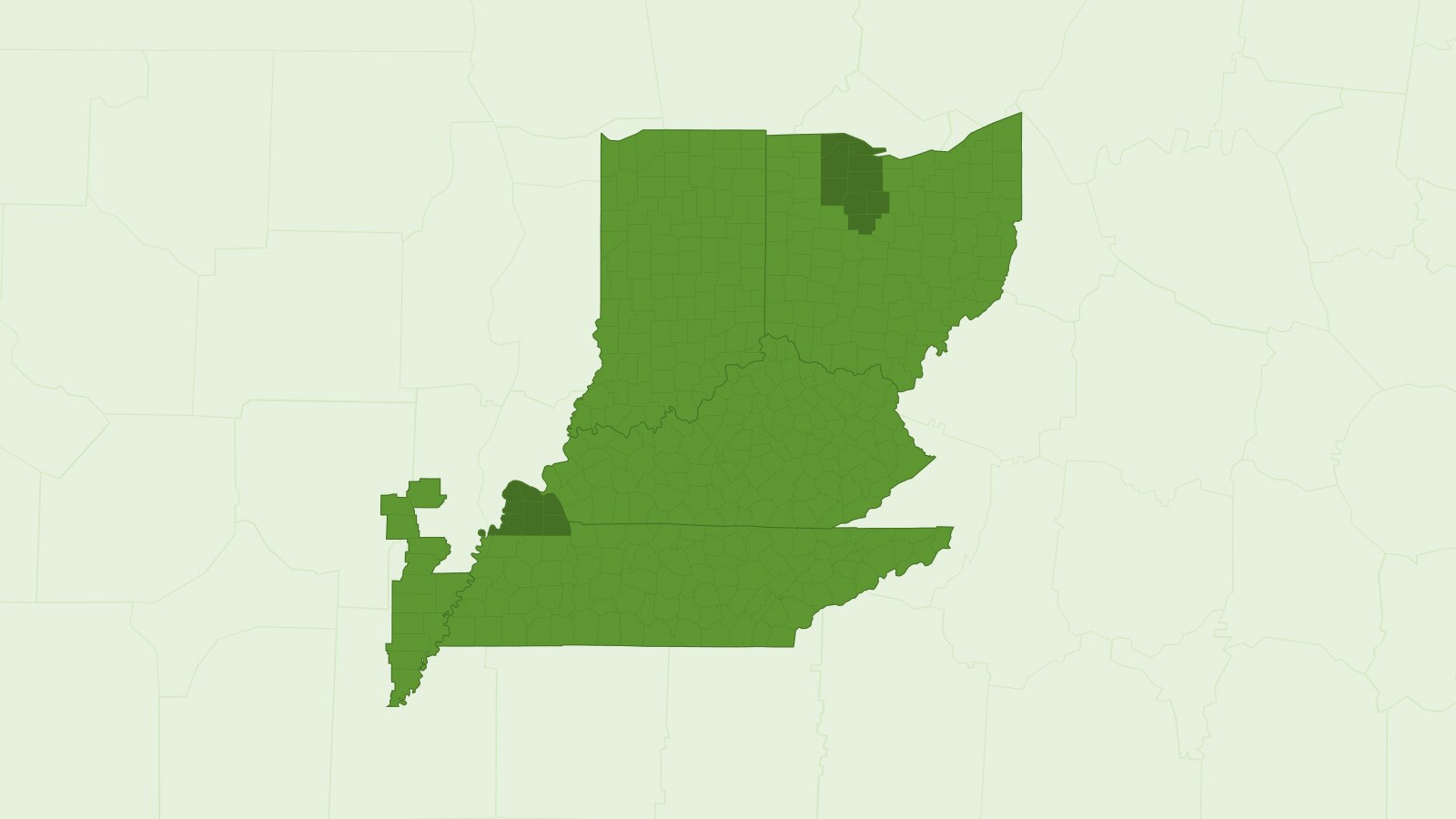

Born out of the need for a reliable source of credit for farmers, the United States created the Farm Credit System in 1916. As a part of the Farm Credit System, Farm Credit Mid-America serves the credit needs of farmers, agribusinesses and rural residents across Arkansas, Indiana, Kentucky, Missouri, Ohio and Tennessee.

As a financial services cooperative, we are owned by our customers and keep them at the heart of everything we do. Backed by over $38 billion in assets, we provide loans, leases and crop insurance to help farmers, producers and agribusinesses reach their potential. And because we are customer-owned, we returned $230 million back to our customers in 2023 in the form of patronage. In 2018, we expanded our home lending solutions with the launch of Rural 1st® which provides rural home, construction and lot loans to current rural residents, as well as those looking to live the rural lifestyle.

Even after all of these years, we remain committed to our purpose of securing the future of rural communities and agriculture – because we know that a brighter future for rural America is a brighter future for us all.